KCA Spot Rate

| Rate For | Ex-Gin Prices | Up-Country Expenses | Spot Rate Ex-Karachi | c/lbs |

| 37.324 kgs | 7,800 | 145 | 7,945 | 87.62 |

| 40.0 kgs | 8,359 | 155 | 8,514 | 84.61 |

SINDH COTTON MARKET UPDATES

200 cotton bales of Sindh stations were traded between at Rs.8000 (88.22c/lbs) PMD ex-gin.

| Bales | Sindh Station | Rate | c/lbs |

| 200 | Ghotki | 8000 | 88.22 |

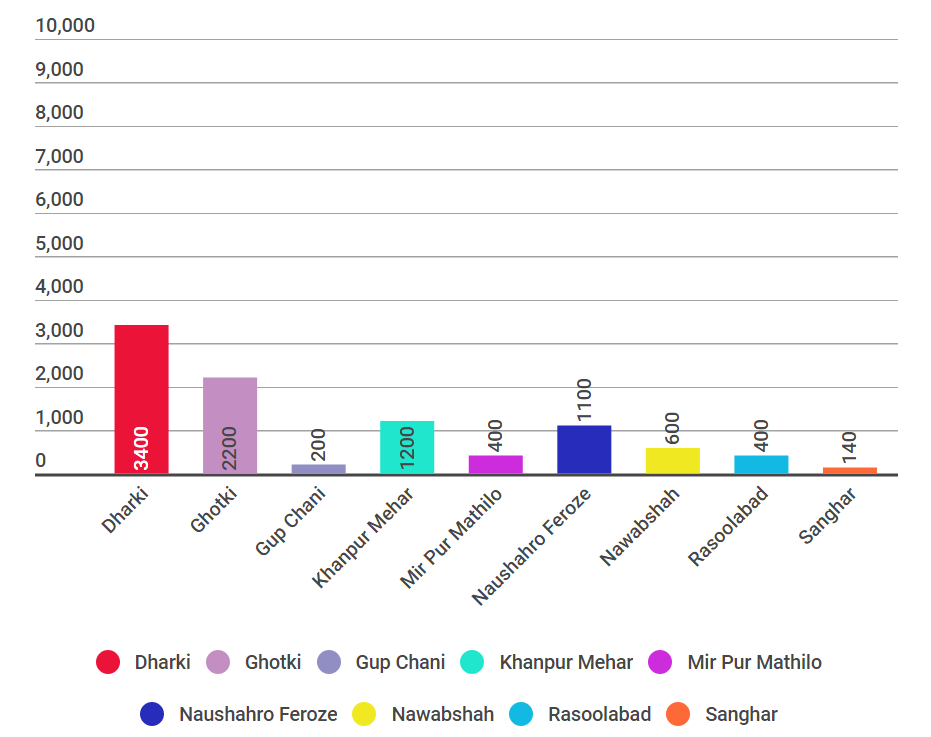

LAST 5 DAYS COTTON TRANSACTION IN SINDH

| Stations | Quantity |

|---|---|

| Dharki | 3400 |

| Ghotki | 2200 |

| Gup Chani | 200 |

| Khanpur Mehar | 1200 |

| Mir Pur Mathilo | 400 |

| Naushahro Feroze | 1100 |

| Nawabshah | 600 |

| Rasoolabad | 400 |

| Sanghar | 140 |

Sindh Transaction Reported on 2nd January 2018

PUNJAB COTTON MARKET UPDATES

12,800 cotton bales of Punjab stations were traded between at Rs.8000 (88.22 c/lbs) to Rs.8100 ( 89.33 c/lbs) PMD ex-gin.

| Bales | Punjab Station | Rate | c/lbs |

| 2200 | Kot Shabzal | 8000 / 8050 | 88.22 / 88.78 |

| 600 | Liaquatpur | 8000 | 88.22 |

| 2600 | Khanpur | 8000 / 8100 | 88.22 / 89.33 |

| 5600 | Rahimyar Khan | 8000 | 88.22 |

| 400 | Mian Chano | 8000 | 88.22 |

| 1000 | Rajanpur | 8000 | 88.22 |

| 400 | Dera Ghazi Khan | 8000 | 88.22 |

Cotton News

The All Pakistan Textile Mills Association (APTMA) chairman Aamir Fayyaz has urged the government to announce and lay down the implementation mechanism for the agreed long-term policy for the revival and growth of the textile industry. "An early announcement of the policy will help reverse trade account deficit and thereby contribute to the country's progress and prosperity," he stressed.

It may be noted that the Prime Minister in his meeting with all textile industry stakeholders in Sep had very wisely desired the Federal Textile Ministry and the textile industry to come up with a long-term policy for the revival and growth of the textile industry.

The Federal Textile Board, in its follow up meeting with all stakeholders, had unanimously proposed various initiatives as a long-term policy to be announced at the earliest enabling requisite investment to generate exportable surplus and achieve additional $20 billion exports in the shortest time-frame to overcome the menace of growing trade deficit, the biggest economic challenge for the government.

Chairman APTMA said the policy has been devised for the restoration of the international competitiveness of Pakistan's textiles whereby 1000 garment and stitching plants are expected to materialize to make the best of the opportunity.

"The expected outcome of the policy is an exportable surplus of $20 billion; development of a skill workforce of 0.7 million; gender balance; achievement of Social Standards and GSP plus prescriptions; US$9 billion new investment; revival of backward & forward linkages in the supply chain; which all will help reverse trade account deficit."

He said the policy would provide for existing duty drawbacks to be extended for 5 years and for increasing drawbacks annually by 1 percent for garments and made-ups; provision of gas at an all inclusive Rs 600/mmBTU to the industry across the country; withdrawal of Rs 3.50/kWh surcharge on electricity to bring its tariff at par with region @ Rs 7/KWh; establishment of commercial enclaves in major cities with provision of rent-free space and other facilities for foreign brands to establish their buying houses; for skill development of men and women provision of Rs 0.1 million training cost per annum per worker to garmenting units; extension of LTFF scheme to indirect exports and for infrastructure for garment plants.